GST implementation to be a game changer for logistics and transportation procurement in India

Abstract

The regulatory reforms, proposed in the recently passed GST bill, are more likely to present opportunities for trucking companies and shippers to rationalize and re-engineer transportation and logistics procurement. Until now cross border transportation within states of India involved challenges such as multiple state taxes across borders, five to seven hours of delay in inter-state check points, high variability and unpredictability in shipments. As a result, the logistics costs are pushed up in the form of higher-than-optimal inventory in warehouse and cost of lost sales. Logistics costs in India are two to three times more than global average.

Introduction:

The Goods and Service Tax (GST) bill was passed by the Government of India in August 2016. The regulatory reforms proposed in the bill are more likely to present opportunities for trucking companies and shippers to rationalize and re-engineer transportation and logistics procurement. Until now cross border transportation within states of India involved challenges such as multiple state taxes across borders, five to seven hours of delay in inter-state check points, high variability and unpredictability in shipments. These factors have led to additional logistics costs in the form of higher-than-optimal inventory in warehouses and cost of lost sales. This makes logistics costs in India two to three times higher than the global average.

Overview:

In this whitepaper, we would discuss the key elements in GST bill that would support the growth of logistics and transportation sectors. We provide insights on expected transformation in Indian logistics sector, the level of changes adopted in trucking market, and warehouses and distribution pattern.

We would analyze how market dynamics can shift from regional players to organized players in the logistics industry post the implementation of GST bill. We also present a detailed analysis on the sustainability of established regional players in next two to three years. And finally, we provide an overview on the importance of understanding the shift in service provider landscape while planning transportation and logistics procurement strategy.

Recommendation:

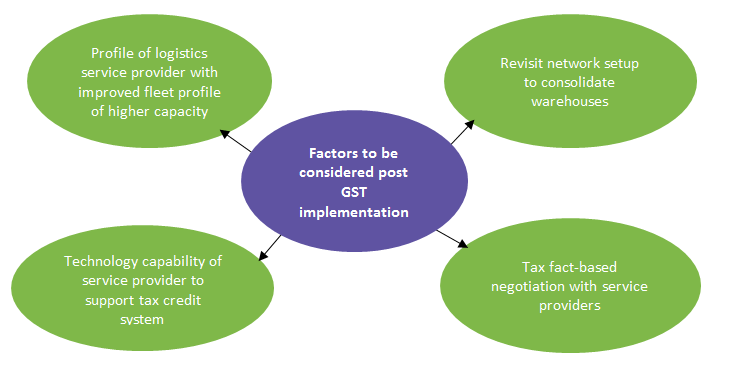

With GST implementation around the corner, logistics service provider and manufacturers would revamp their supply chains, realign the location of warehouses and redraft their use of corridors and transportation options. This is due to expected increase in penetration of organized players, increasing business collaborations among new entrants and fresh unorganized-turned-organized players.

A shift is likely towards the consolidated warehouses which are expected to be placed closer to the manufacturing/import/export locations. However, the shift in warehouse strategy is expected to create increased secondary freight spend. Hence it is critical to do a location-based comparitive analysis on freight preference and identify an ideal warehouse location for secondary distribution.

What troubles logistics and transportation sector in the current tax system?

Indirect tax system – Impact on logistics sector

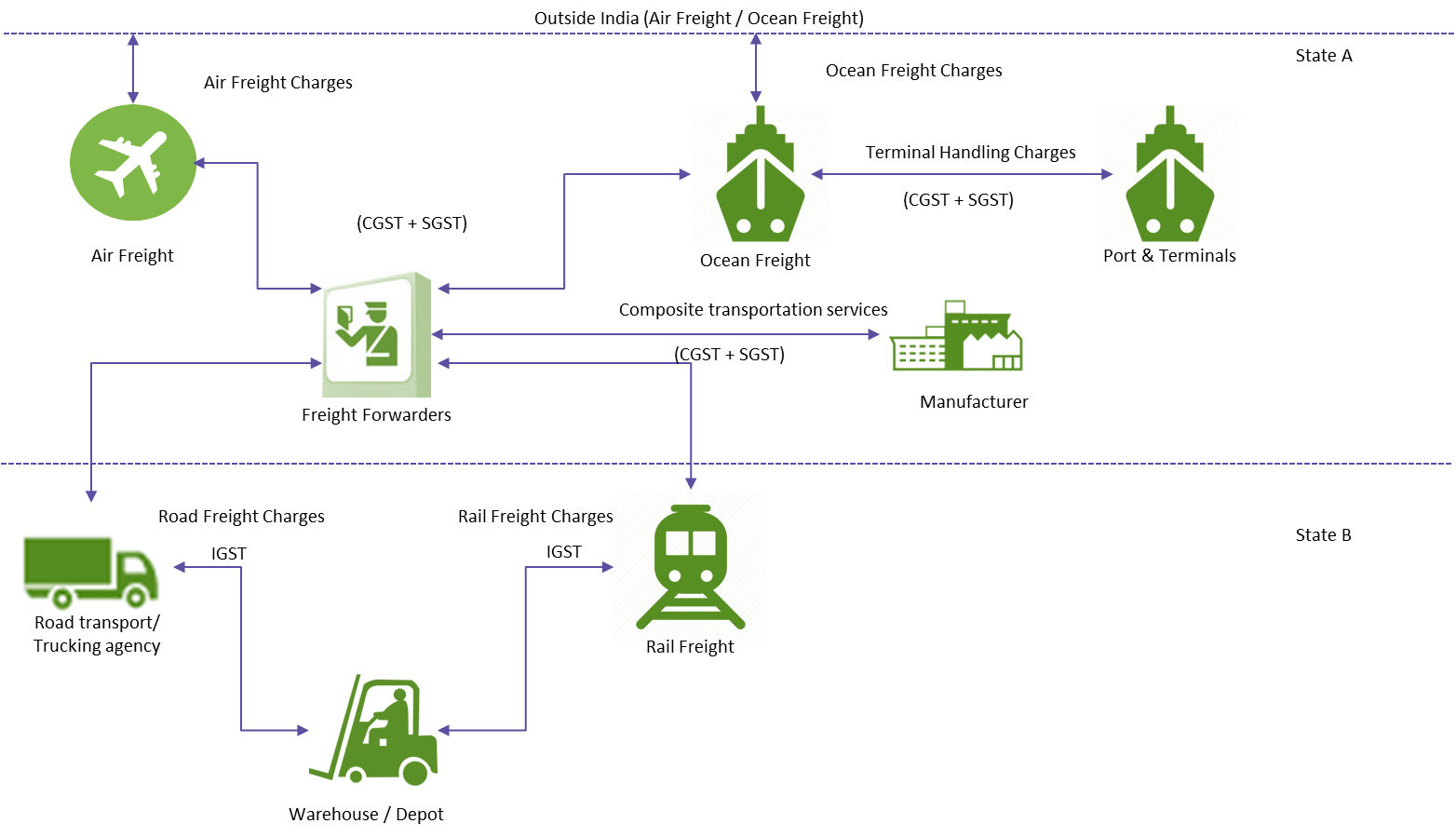

Indirect tax system is seen as inefficient and opaque element for operating business in India. There is a considerable impact on logistics and transportation sector as goods manufacturers have to incur an overall tax of 29 to 30 percent while delivering goods from plants to retail shelves.

Given the existing complex tax structure, logistics procurement framework needs to be designed based on the spend involved in central sales tax and state value added tax rather than operational efficiency attained with logistics network optimization. Also, the manufacturers’ choice of procuring transportation service providers, distribution or inventory centers would depend on the amount of tax spent in delivering final goods to retail shelves or end users for consumption.

Scenarios leading to additional spend on transportation activity

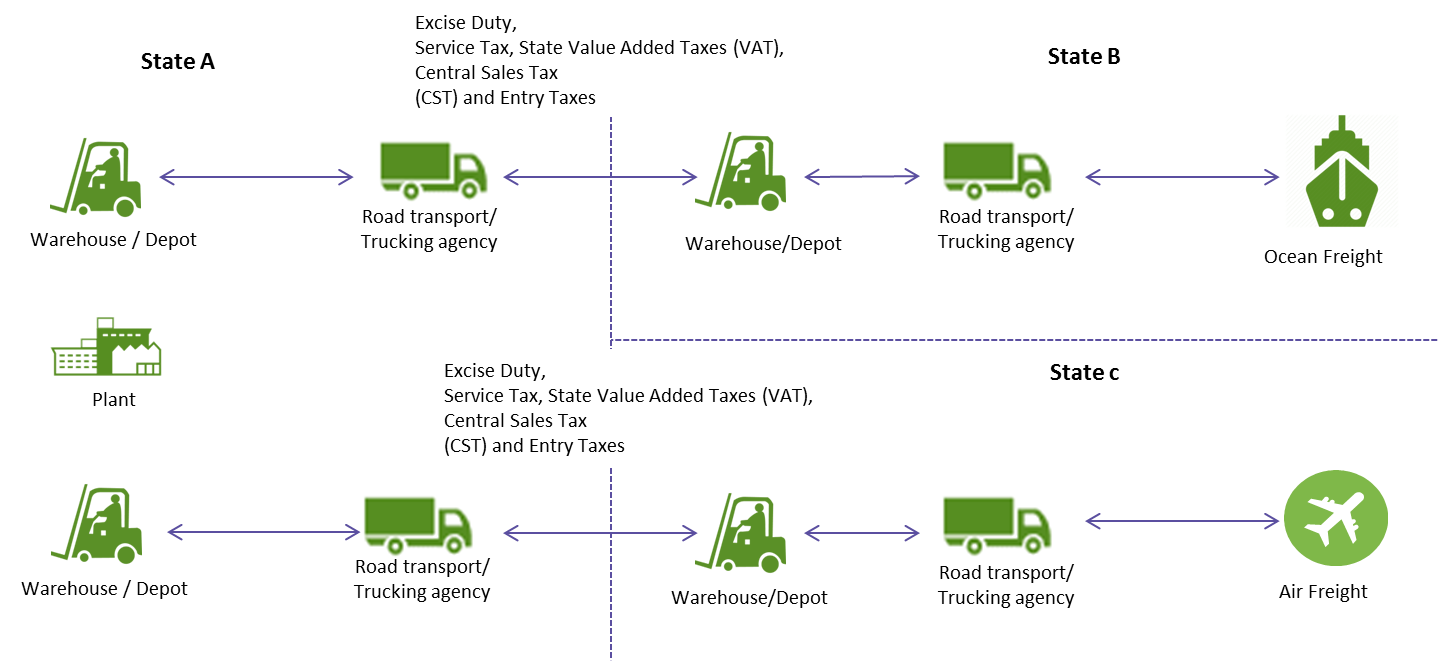

Additional warehouse cost to avoid central sales tax

- Under existing tax system, companies with large scale of operations across multiple states have to pay central sales tax, state value added tax and entry levies for transportation of goods across states.

- To avoid these taxes, companies set up smaller warehouses in each state so that it could possibly claim central sales tax; however, additional cost of procuring warehouse is incurred.

- Warehouse procurement gets even worse for companies in regions with capacity constraints and higher rental rates.

Longer freight time - cross border transportation in India

- In India, average truck delays of five-seven hours at inter-state check points for collection of entry taxes and other state taxes cause at least 15-20 percent increase in freight rates per trip.

- The cross border transportation increases waiting time and logistics cost. The current rate of 20 to 30 percent transit time and 15 to 20 percent logistics costs are higher when compared to global average.

Procurement of logistics and transportation – based on tax system

- Manufacturing companies design logistics sourcing and network based on the current system of tax, rather than considering operational efficiency.

- Companies tend to increase the number of warehouses based on the region of target customer, retailers and wholesale distributors.

- In the case of trucking service procurement, manufacturers engage with regional players with invoice generated specific to the region of distribution. In this situation, manufacturers have to handle large number of invoices and payments which would cause errors and confusion.

Opportunities in logistics and transportation sector

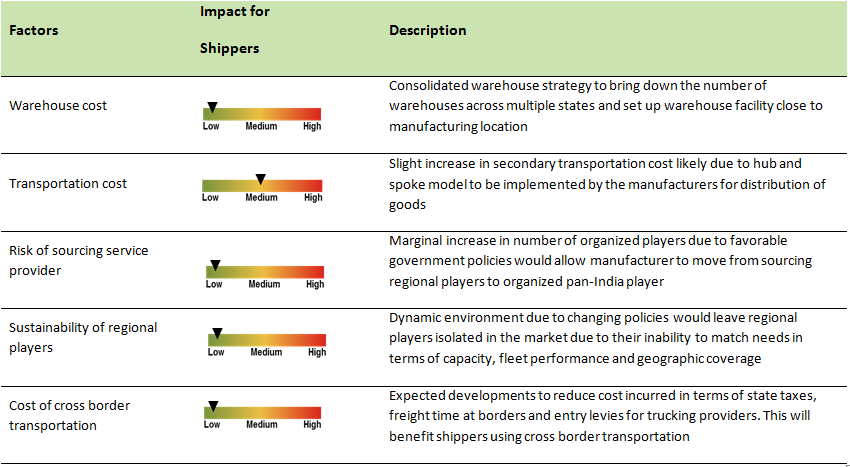

Consolidation of warehouses:As recommended by GST council, manufacturers had to incur additional 1 percent tax on sales of goods in other states for a period of 2 years post implementation of GST. After that maunfacturers would consolidate their warehouses and setup larger facilities with an opportunity to save 3-4 percent in warehouse costs.

Reduction in trade barriers: Expected removal of challenging factors such as increased freight time due to trade barriers such as check-post inspection, filling waybills/entry permits and paying entry tax and local levies.

Re-evaluation of sourcing: Shippers sourcing regional trucking service and multiple warehouses would re-evaluate procurement strategy for logistics and transportation category. They would prefer consolidated and larger warehouse setup, optimized logistics network for secondary transportation and capability of the service provider(fleet size, technology, future scope and warehouse capacity).

Free trade warehousing zones: Warehouse capacity in India is expected to increase with likely increase in volume post implementation of GST with the policy of tax-free supply to free trade warehousing zones for exports. Shippers would look to capitalise on the oppurtunity of tax savings in the free trade warehousing zone. However, regulatory constraints would be imposed.

Logistics consideration post GST implementation:

Expected decrease in logistics cost:

Cost of logistics and transportation is expected to decrease by 1 to 2 percent in 1 to 2 years after implementation of GST with improved warehouse facility close to manufacturing locations (reduction in smaller warehouses by 30 to 40 percent) and expected increase in investment to develop fleet profile and technological backend.

Change in service provider landscape:

Service providers will reconfigure the current fleet size and try to align with emerging needs of the market.

The expected increase in availability of efficient and organized players will increase the scope for consolidation activities including inbound and secondary transportation activities.

Manufacturers would rethink conventional habit of outsourcing due to expected improvement in service levels and more competitive pricing due to increased penetration of organized players and fresh unorganized-turned-organized players.

Sourcing of transportation service:

Manufacturers prefer service providers with pan-India presence to leverage on volume-based negotiation and multiple-service scope (3PL, packaging, warehouse and distribution) during contractual aggrement. More importantly it allows the manufacturer to keep track of tax-based expenses under a single system. Engaging with a regional player without technological support would increase risk of financial leakage due to audit errors.

Impact analysis – Post GST implementation:

|

Routes – logistics re-engineering |

Industry of focus |

|

Chennai- Bangalore |

Automobile and pharmaceutical |

|

Mumbai-Gujarat-Rajastan-NCR |

Chemical, machinery and textile |

|

Delhi-Mumbai |

FMCG, automobile and pharmaceutical |

Future outlook on logistics and transportation in India 2016-17:

In the next one year, Indian logistics industry would transform the existing unorganized market to an organized one. The expected increase in flow of funds will help to set up advanced ware house facilities, expand an existing facility, and upgrade fleet profiles. Service provider could start identifying the core industies(Automobile, pharmaceutical, e-commerce and FMCG) that would have an impact on the logistics cost post the implementation of GST. Based on the demand to match logistics needs, service provider could invest in technology, fleet size, geographic expansion and warehouse location.

With a procurement perspective, manufacturers can scrap tax-based procurement system and redesign the logistics framework. Primarily, setting up warehouse facilities using a hub and spoke model would optimize their usage. It will also marginally increase secondary transportation activity with increase in lead distance. And finally, shippers can increase the use of secondary transportation by procuring service providers with advanced fleet, wider geographic reach and centralized technology backend to manage the fleet network.

Related Insights:

View All

Get more stories like this

Subscirbe for more news,updates and insights from Beroe